"The first quarter of 2008 has seen excellent growth in our retail deposit base. Bradford & Bingley has a strong capital base and has funded its business activities through 2008 and into 2009. We have a focused strategy, and a business model that is adaptable to changing market conditions."

Given the deep discount of the rights issue - the new shares offered at 82p compared with the prior close of 158p - one wonders why an underwriter is needed, especially as management gives the impression that capital is not urgently needed.

The recent price movements of B&B relative to those of the other financial desperados - A&L and Barclays - suggest that a bit of window dressing ahead of this rights issue might have been underway. Have the underwriters been earning their fees? A steward's enquiry would be most welcome.

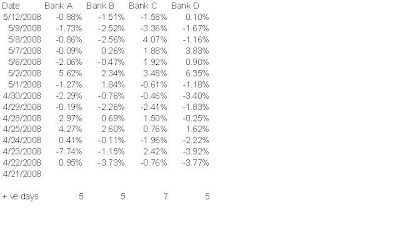

The table above takes the daily price movement (ln (Px/Px-1)). It uses using prices from Yahoo and so ends on Monday 12th. Bank A is Alliance & Leicester, B is Barclays, C is Bradford& Bingley and D is HBOS - which of course already has announced a rights issue.

And the bank with the most price rises over the fourteen days - well B&B of course.